Baby Boomers Are Hitting Peak 65. What It Means For Retirement Planning.

![]()

Author: Anne Stanley

Date: 8/10/2023

View article on Investor’s Business Daily

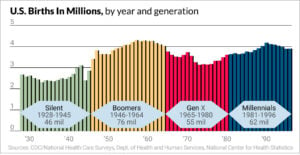

The coming year marks a major demographic and retirement planning milestone for America. It’s Peak 65 — when more Americans will reach the traditional retirement age of 65 in the same year than at any time in history.

The graying of the baby boomer generation will have a huge impact on retirement planning, health care, Social Security, taxes and investing in 2024 and beyond. And that’s not just for Americans 65 and over, but for younger Americans saving for retirement as well.

According to the U.S. Census Bureau’s population projections, about 12,000 people will turn 65 every day in the next year. That’s about 4.4 million in 2024. And by 2030, all boomers — those born from 1946 through 1964 — will be 65 or older. This means one in every five Americans will have reached the traditional retirement age.

Retirement for boomers is different than it was for their parents in the so-called Silent Generation. Life expectancy has improved, and today’s 65-year-old can expect to live at least another 20 years. About 80% of households with older adults — or 47 million such households — are struggling today with money. And they risk falling into economic insecurity as they age, the National Council on Aging says.

The 3-Legged Stool Of Retirement Planning Is Broken

“With the U.S. experiencing the greatest retirement surge in its history, the country’s public and private-sector retirement systems have become obsolete. The old metaphor of the three-legged stool of retirement planning — employer pensions, personal savings and Social Security — no longer holds,” said Jason Fichtner. Fichtner is chief economist at the Bipartisan Policy Center, a Washington, D.C.-based think tank. He authored the economic report The Peak 65 Generation — Creating A New Retirement Security Framework for the Alliance for Lifetime Income, a nonprofit that focuses on protected retirement income and annuities.

A recent survey related to the Peak 65 trend by the ALI found that 51% of Americans between 45 and 75 don’t feel they have enough retirement savings to last their lifetime. And more than a third aren’t confident they’ll have the funds to cover their basic monthly expenses in retirement. According to ALI’s 2023 Protected Retirement Income & Planning Study, half of these Peak 65 Americans have $100,000 or less in investable assets.

The good news: Smart investing choices will make your retirement savings last a lot longer and generate more income.

Baby Boomers And Changes To Retirement Planning

The peak of the boomer generation hits 65 in the coming year.

The peak of the boomer generation hits 65 in the coming year. The number of Americans turning 65 each year has been steadily increasing. Also, 65 is no longer an absolute retirement age. Those born at the end of the baby boom won’t reach Social Security’s full retirement age until they’re almost 68. Full retirement age is when recipients become eligible for unreduced Social Security retirement benefits.

Many older Americans, out of choice or need, are working past 65. Others have been forced to retire earlier than they planned, especially in the wake of the Covid-19 pandemic and economic upheaval.

The Census Bureau reports that the pandemic disrupted labor markets and had a “modest” impact on retirement timing. The bureau’s Survey of Income and Program Participation showed 2.9% of adults ages 55-70 who were employed in January 2020 said they retired early or planned to retire early due to the pandemic. Another 2.3% said they either delayed or planned to delay retirement for the same reason.

Social Security, Medicare Are Running Out Of Money

While the ranks of retirees in the U.S. are growing, pressure also is rising on traditional sources of retirement income. This year, trustees for Social Security and Medicare calculate that Social Security will be able to pay 100% of scheduled benefits until 2033. Without additional funding, benefits would fall after that. The Hospital Insurance Trust Fund, the main fund for Medicare, is expected to pay 100% of benefits until 2031.

According to the Social Security Administration, the past 12 annual Trustees Reports have signaled that Social Security’s reserves would be depleted between 2033 and 2035. “If no legislative change is enacted, scheduled tax revenues will be sufficient to pay only about three-fourths of the scheduled benefits after trust fund depletion,” the SSA says.

Policymakers have offered scores of ideas that could help shore up the trust funds. Many proposals include changes to calculating benefits. Others suggest changes to the annual cost-of-living adjustments, and boosting tax rates on benefits. Increasing payroll taxes is an option. The Social Security tax rate for wages paid in 2023 is set by law at 6.2% for employees and employers, each. The Medicare tax rate is 1.45% each for the employee and employer, unchanged from 2022. But just raising taxes can’t be the only solution.

According to the Peter G. Peterson Foundation, a nonpartisan economic policy think tank, a major reason the current Social Security program is unsustainable is that the number of workers contributing to the program is growing more slowly than the number of beneficiaries receiving monthly payments.

Retirement Planning Challenges

In 1960 — nearing the end of the baby boom generation — there were 5.1 workers per Social Security beneficiary; that ratio dropped to 2.8 in 2022. By 2035, the trustees estimate 2.3 workers will be contributing for each beneficiary. This year, an average of almost 67 million Americans per month will receive a Social Security check, totaling $1 trillion in benefits paid during the year, the SSA says.

The slowing inflation rate is a double-edge sword for both Social Security checks and living costs. Older Americans are still strained from two years of historically high consumer prices. But lower inflation means Social Security recipients will probably see their annual cost-of-living adjustment slashed from 8.7% in 2023 to 2.7% next year.

Last year’s bear market took a toll on retirement savers and retirees’ nest eggs. Fidelity Investments, the biggest provider of 401(k) plans, said the average 401(k) balance fell to $103,900 in 2022 — down more than 22% from 2021. Declines for stocks also hit defined-benefit plans. Poor investment returns in 2022 drove down the average funded ratio for state and local pension plans.

“Volatile markets, retirement portfolios that lost significant value in the past year, high inflation and the Peak 65 phenomenon all create a perfect storm of retirement insecurity for Americans, especially for those close to retirement or recently retired,” ALI’s Fichtner said.

So what can retirement savers and retirees do?

Threats To Retirement Investments

The two biggest threats to financial security in retirement are, for most people, longevity and purchasing power, says Robert Powell, a certified financial planner and editor of Retirement Daily. There’s no single answer. The challenge is finding the right balance among investing strategies, he says.

Dividends are great, but “simply investing in dividend stocks won’t guarantee that you won’t outlive your money. You might have to reduce your standard of living,” he said. “Annuities can protect against longevity risk but can’t guarantee you won’t lose purchasing power.”

The 60/40 Retirement Portfolio

The 60/40 portfolio, where 60% is invested in stocks and 40% in bonds, is considered the starting point in retirement planning. That so-called balanced portfolio was popular in the ’80s and ’90s.

But recent research shows it isn’t keeping up so well in the new millennium. That’s thanks to historically low interest rates in the past decades and a series of bear markets. Advisors are now advocating for greater asset diversity and alternative investment strategies to sustain long-term growth.

Besides taking another look at asset strategies, researchers are reconsidering another traditional approach: the declining equity glide path in retirement planning. The declining equity glide path is known as the “100-minus-your-age” calculation. That means if you are 70, you would have just 30% of your portfolio in equities. The formula is designed to reduce equity risk as you age.

But for many who are investing for and living in retirement, leaning into active investing — and equities — could be better.

Retirees Own More Stocks Than Ever

John Rekenthaler, director of research for Morningstar Research Services, says today’s retirees have become adventurous, and now own more stocks than ever before.

The average stock weight for target-date 2025 funds is 44%, Rekenthaler says. That’s 4% above what the 60/40 formula recommends. He spotlights a current report from Vanguard that says two-thirds of Vanguard’s older 401(k) investors who make their own investment choices have most of their assets in stocks.

Rekenthaler says Americans, on average, are wealthier than they have ever been, especially within the investor class. Investors have more assets. That, combined with long bull markets and weak competition from bonds, means “stocks became the only legitimate game in town. And investors very much noticed,” he said.

“My contrarian side regrets the stock market’s popularity,” he wrote recently for Morningstar. “Better to invest in securities that are distrusted than those that are loved.” But, he added, “At least on the surface, U.S. equities do not appear to be egregiously priced.”

When More Stocks Is Better: The Rising Equity Glide Path

Retirement experts Michael Kitces and Wade Pfau found that a rising glide path, such as one starting with 30% in equities and going up to 70% over 30 years, yields better outcomes for retirees. Rising equity glide paths fared better than static, they say, which performed better than declining glide paths.

Optimal rising glide paths, says Kitces, often required no more maximum equity exposure than the typical 60/40 portfolio.

Kitces writes on his Nerd’s Eye View blog that “research shows that despite the contrary nature of the strategy — allowing equity exposure to increase during retirement when conventional wisdom suggests it should decline as clients age — it turns out that a rising equity glide path actually does improve retirement outcomes.” If market returns are bad in the early years of retirement, he says, a rising equity glide path ensures that investors will dollar cost average into markets at cheaper and cheaper valuations; and if markets are good, investors “won’t have a lot to worry about in retirement anyway.” (Read more on the research.)

Rising equity glide paths create a “heads you win, tails you don’t lose” outcome in securing a starting goal, Kitces and Pfau say.

Covered Calls Can Help Grow Your Nest Egg

Another investing approach to consider is covered calls. This options strategy involves the purchase of stock and the sale of calls on a share-for-share basis. Calls are a contract between the buyer and seller to purchase a certain stock at a certain price until a set expiration date.

The strategy provides income in stable markets, income and some capital gains in rising markets, and some protection of capital in declining markets. The primary goal of covered writing is income. Covered writing is not simply a buy-and-hold strategy. It involves thinking ahead about the right moves in both bullish and bearish scenarios.

“Retirees may be limiting their upside, but they’re still getting some stock upside plus the guaranteed premium,” said Rob Leiphart, vice president of financial planning at RB Capital Management.

Pros And Cons of Annuities In Retirement Planning

As Peak 65 approaches, “the retirement savings crisis is about to become a retirement income crisis,” said Jean Statler, CEO of the Alliance for Lifetime Income. “Awareness and understanding of annuities are increasing, so it’s encouraging to see people reevaluate their retirement savings and add annuities to their plan.”

An annuity is a contract with a life insurance company that requires regular payments. Retirement savers can buy annuities with a portion of their portfolio in either a lump-sum payment or with payments over time. Retirement savers can buy an annuity contract alone or with the help of their employer.

You can choose from a variety of annuities, including fixed, fixed index and variable. You can defer payments, starting at a future date. Or they can be immediate, starting soon after the purchase of the annuity.

The big benefit: Annuities provide guaranteed income and meet the need for longevity protection. On the other hand, these products may have high fees, lack liquidity and may be very complex.

According to LIMRA’s 2022 Individual Annuity Sales Survey, total U.S. annuity sales in 2022 reached $312 billion, a 23% increase from 2021 and 18% higher than the prior record of $265 billion in 2008.

Dividend Stocks For Retirement

Bryan Hayes, a strategist for Zacks Equity Research, said dividend stocks “can give retirement investors a smart option to replace low-yielding Treasury bonds (or other bonds).”

“There’s no doubt that 2022 was a challenging environment for stocks,” Hayes wrote in a note for Zacks. “Yet, it highlighted the many strengths of dividend equities, which outperformed non-dividend stocks and bonds during the year.”

Hayes added that dividend stocks can provide some protection against inflation. That’s because some dividend-paying companies can raise prices to pass on higher costs. “The dividend strategy is one that has the potential to outperform in multiple economic scenarios.”

Dividend stocks have historically beat the S&P 500 with less volatility, and they provide income from both the capital appreciation of the stock and dividend payments. Investors can buy dividend stocks via funds or by buying the individual stocks. Dividend stocks usually pay a set amount each quarter and the best companies increase their dividend over time.

But with the S&P 500 doing so well this year, and with CDs boasting yields of 5%, compelling dividend yields are harder to find. Also, 5% risk-free is tough to beat. Just 11 S&P 500 stocks, including utility PG&E (PCG) and Pioneer Natural Resources (PXD), pay a dividend of 6.5% or higher, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith. That’s probably the smallest dividend yield investors might accept in exchange for taking on stock risk. Read more at IBD’s The Income Investor.

Take Advantage Of Tax-Law Benefits

Everyone can benefit from long-term tax planning and tax-advantaged investing. Work on your tax strategies now. Big tax breaks are ending in 2024 and 2025, the same time America reaches Peak 65.

The Tax Cuts and Jobs Act of 2017 made sweeping changes to the tax code. Many provisions of that law will sunset in the next two years, including wider tax brackets and changes in capital gains taxes. The overhaul lowered most individual income tax rates, including reducing the top marginal rate to 37% from 39.6%. The law also created a single corporate tax rate of 21%.

While it’s likely Congress will extend some provisions, retirement savers can start planning now.

H.R.976 would make permanent the reductions in individual and capital gain tax rates. It also would increase the standard tax deduction for individual taxpayers. Status? Sponsors introduced the bill Feb. 10. It’s now in the hands of the House Committee on Ways and Means.

Folks saving for retirement may want to accelerate income to take advantage of the lower tax brackets now. Other options: Convert a traditional IRA to a Roth IRA, and harvest capital gains.