Retirees That Annuitize Income Spend Twice as Much as Retirees With an Equal Amount of Non-Annuitized Savings

– In Guaranteed Income: A License to Spend, Retirement Income Institute Fellows David Blanchett and Michael Finke examine how Americans achieve their lifestyle goals in retirement through annuitized income –

WASHINGTON, D.C. – Retirees with assets that annuitize income spend twice as much as retirees with an equal amount of non-annuitized savings, according to a new analysis by the Alliance for Lifetime Income’s Retirement Income Institute (RII).

In their newly released study, Guaranteed Income: A License to Spend, RII Fellows David Blanchett and Michael Finke examine how Americans are far more likely to achieve their lifestyle goals in retirement through annuitized income, overcoming the uncertainty of life expectancy and the reluctance to spend down savings.

Using data from the Health and Retirement Study (HRS), Blanchett and Finke examine households with at least $100,000 in savings and compare how much money they could be spending in retirement to how much they are actually spending based on existing guaranteed income sources and assuming financial assets are annuitized. They pair these findings with those of a proprietary survey of 2,051 adults nationwide regarding behavioral tendencies that may influence their spending in retirement.

Their analysis centers on the challenge Americans face when determining how much they’re able to spend from their investments each year in retirement – an inherently difficult task given that both the length of retirement and returns on assets are unknown. A retiree can either spend generously and risk outliving their savings or spend conservatively and miss out on the lifestyle they envisioned. A retiree who is concerned about outliving their savings will spend less.

Blanchett and Finke find that every $1 of assets converted to guaranteed income could result in roughly twice the equivalent spending compared to money left invested in a portfolio. This effect suggests that the explanation for under-spending of non-annuitized savings among retirees is likely both a behavioral and a rational response to longevity risk.

“Essentially, annuities with lifetime income protection give retirees a psychological license to spend their savings in retirement,” said Blanchett, Head of Retirement Research at PGIM DC Solutions. “Retirees clearly prefer to live off income, but many don’t feel comfortable depleting down assets to fund a lifestyle. This is an unfortunate paradox since funding a lifestyle is what motivates people to save for retirement, and few retirees indicate a desire to pass on significant wealth at death.”

Finke, Professor and Frank M. Engle Chair of Economic Security Research at the American College of Financial Services, added: “Increasing the share of wealth allocated to annuitized income can not only reduce the risk of an unknown lifespan, it can also allow retirees to spend their savings without the discomfort generated by seeing one’s nest egg gradually get smaller.”

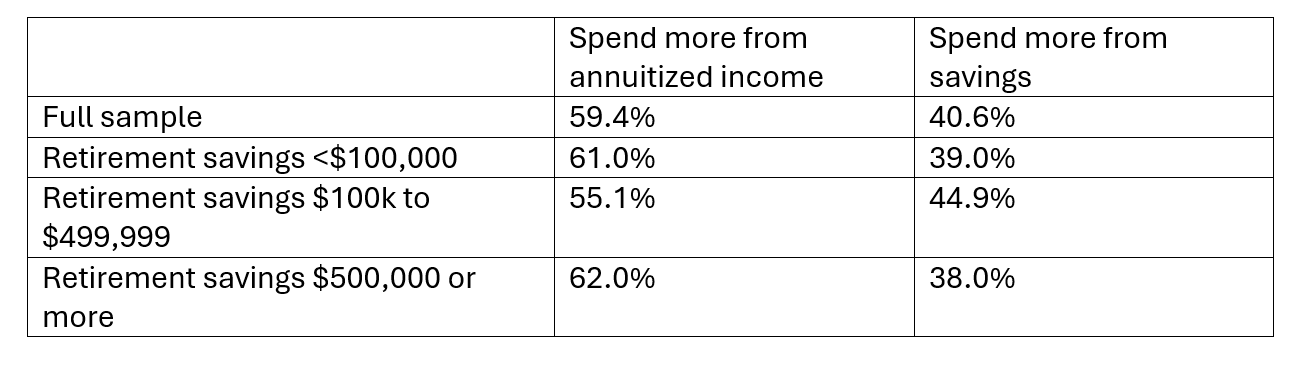

The survey of 2,051 Americans included in Blanchett’s and Finke’s analysis finds that 60% of respondents would feel more comfortable spending on nonessential activities such as going on vacation or eating dinner with friends in retirement if they received an additional $10,000 of income for life than if they had an additional $140,000 of retirement savings (40.6%). The wealth amount represented the average cost of $10,000 of annuitized income at retirement. The increased willingness to spend from income was just as high among retirees who had saved $500,000 or more.

Spending Retirement Savings is a Common Cause of Anxiety

Blanchett’s and Finke’s analysis corresponds with findings in the Alliance’s 2024 Protected Retirement Income and Planning (PRIP) Study, a new survey of 2,516 consumers in the U.S. ages 45 to 75 regarding their attitudes and behaviors toward retirement savings.

Nearly half of retirees (46%) acknowledge that spending their savings gives them anxiety. The level of discomfort is tied to asset levels: 55% of those with less than $100,000 in assets are anxious about their spending in comparison to 48% of those with assets between $100,000 and $500,000. Nearly a third of retirees (32%) indicate they are spending money faster than they anticipated.

Compounding the anxiety of many Americans is the lack of confidence in the long-term solvency of Social Security. Only 58% of respondents are confident Social Security will provide income for the rest of their life.

About The Alliance for Lifetime Income

The Alliance for Lifetime Income (ALI) is a non-profit 501(c)(6) consumer education organization based in Washington, D.C., that creates awareness and educates Americans about the value and importance of having protected income in retirement. Our vision is for a country where no American has to face the prospect of running out of money in retirement. The Alliance provides consumers and financial professionals with unique educational resources and interactive tools to use in building retirement income strategies and plans. We believe annuities – one of only three sources of protected lifetime income – can be an important part of the solution for retirement security in America. The Alliance’s Retirement Income Institute houses the leading retirement scholars and experts who create evidence-based research and analysis, with practical ideas and actions to help protect retirees.